Change is inevitable in an era of a fast-paced technical revolution with a population relying on technology for almost anything and everything. The latest of all, blockchain technology is spreading its wings in every sector. DeFi is the result of blockchain technology’s makeover in the finance sector. Meanwhile, NFTs are grabbing the attention of gamers, artists, and real estate agents. Ever wondered what the scenario will be if DeFi and NFTs are combined? Welcome to the world of DeFi NFTs. Dive straight in through the following headings

- What are DeFi NFTs?

- How do NFTs store value?

- How can NFTs benefit DeFi?

- Use cases of NFTs in decentralized Finance

- Top DeFi projects leveraging NFTs

- Bottom line

What are DeFi NFTs?

Let us get it straight. DeFi NFTs are Non-Fungible Tokens in the Decentralized Finance sector. So before moving on to that, let’s take a quick recap on DeFi and NFTs.

DeFi

“Decentralised finance” refers to a peer-to-peer financial niche that uses cryptocurrency and is created on top of blockchain technology. It refers to decentralized, non-custodial infrastructure-based financial services like investing, borrowing, lending, trading, etc.

It entails the development of numerous financial services and products using decentralized networks and open source technologies. The objective is to develop and run decentralized financial applications (dApps) on a transparent and trustless platform, such as permissionless blockchains like Ethereum and other peer-to-peer (P2P) protocols.

Related article: What is DeFi 2.0, and why does it matter?

Features of DeFi

Decentralized Finance is changing the face of how we do transactions as they are not controlled by a central authority. The transactions are programmable and are recorded in blockchain ensuring complete transparency. Single points of failure are eliminated. The data is recorded on the blockchain and spread across thousands of nodes, making the shutdown of services nearly impossible. Defi also helps in maintaining pseudonymity

Also, DeFis have inherited advantages of blockchain technology like immutability, accessibility, and interoperability as they run on the blockchain.

These are the features of Decentralized Finance transactions which make it different from conventional economics.

NFT

Non Fungible Tokens are the digital form of physical assets coded into the blockchain, a form of a distributed ledger. They are crypto tokens with unique identification codes and metadata. they are not fungible, i.e., they cannot be changed or modified hence the name non-fungible. Every NFT is a unique representation of an asset or security with a unique owner and unique properties.

NFTs can’t be duplicated or replicated. Let’s look at an example where an artist owns a digital artwork and makes it publicly available in the digital world. However, anybody may reuse the image by right-clicking to resell it. So NFTS offer a solution here, When art is tokenized and transformed to NFTs, however, the original owner retains ownership evidence.

All reproductions are immediately recognizable, and copies remain duplicates rather than originals. NFT isn’t limited to digital painting; it may also include various asset classes like real estate, tweets, poetry, songs, musical compositions, artworks, and in-game assets.

Thus the advantages of NFTs are:

- Uniqueness

- Transparency

- Proof of ownership

- Huge investment potential

The fundamentals of the concept of DeFi and NFTs show us that NFTs are a unique way of ownership of assets, and DeFi provides a framework for creating and capturing value. Thus together, DeFi and NFT open the door to many possibilities.

Related article: What are Non-fungible tokens or NFTs?

Therefore DeFi NFTs are those NFTs used in the DeFi sector that helps facilitate various DeFi transactions and activities.

How do NFTs store value?

To understand what kind of value NFTs store, first, we need to understand the kinds of market prospects that they open up. Once we get acquainted with that, it will help us better use that knowledge to construct businesses around them.

It is a cumbersome task to prove the ownership of digital assets before. But NFTs are the game-changers. Clear Property rights and ownership rights can help facilitate a marketplace. And when trading happens, the ownership has to be transferred from the seller to the buyer.

Hence NFTs empower parties to agree on what constitutes ownership. They enable markets to be built around new aspects of transactions, such as buying and selling things that could never be traded before or facilitating more effective and insightful transactions.

NFTs promise a variety of value propositions other than ownership rights. NFT opens up the possibility of making profits for a lifetime. For instance, an artist can make smart royalty contracts for NFT so that a particular percentage of the future transactions has to go to the original owner. So, whenever there is a trading of the asset, the original owner can receive a small share of the profit.

Besides being digital assets, NFTs also act as digital tickets to exclusive events or communities. These can give its owners access to celebrity discord groups or zoom meetings, a special invitation to exclusive events etc i.e., benefits that can be enjoyed only by the community.

As a result, having an NFT essentially makes you an investor, a club member, a brand shareholder, and a loyalty program member, all at once.

Related article: Top 10 Doubts And Questions On NFTs Answered

How can NFTs benefit DeFi?

NFTs are making their appearance in almost all sectors. So how do these NFT benefit the financial sector or DeFi?

We are used to a traditional finance sector where a central authority approves the reliability and authenticity of entities involved in the transactions. There is always a central authority that monitors every activity.

The challenges of these conventional systems include tangible expenses, physical delays, and inefficiency in handling instabilities. There is also a probability of fraud when we depend on intermediaries in transactions. Such issues are addressed in DeFi.

NFT is presently being used in many DeFi initiatives because of its capability to store value and act as immutable proof of ownership. DeFi, for its part, assists in securing this value by performing various transactions using tokenized assets.

Properties of NFTs can make them useful for various financial solutions. These two technologies complement each other and, when combined, provide new economic potential.

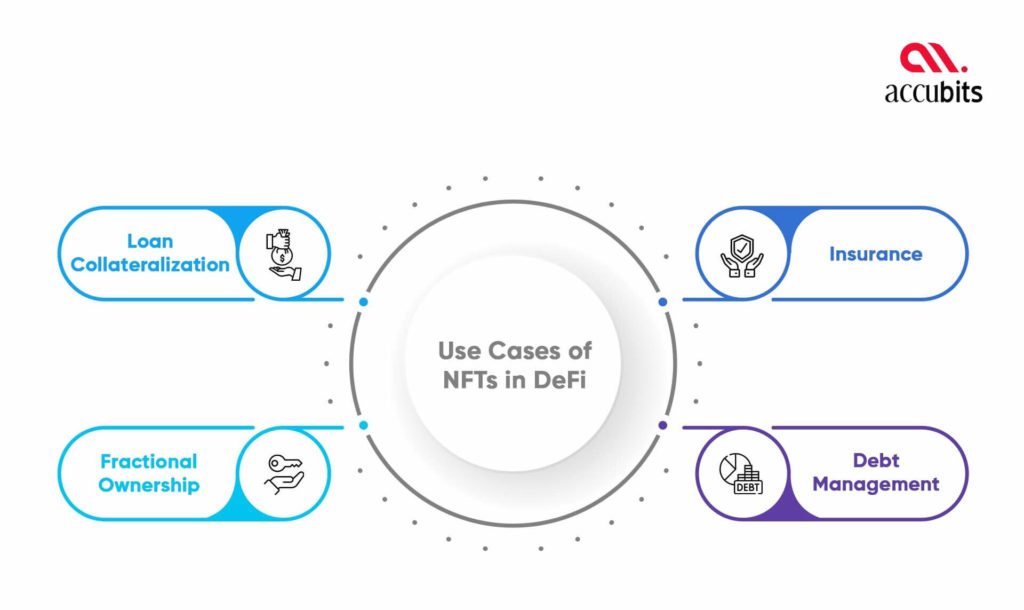

Use cases of NFTs in decentralized Finance

Let us see some special use-cases of NFTs in Defi:

Loan collateralization

Whenever someone needs a loan, they submit collateral to reduce lenders’ risk. A bank or a central authority decides the collateral value and interest rates, then the lender lends the loan. DeFi has changed this conventional setup. As the term implies, it is Decentralised, or there is no central authority.

In this economic ecosystem, a borrower uses the NFT as the collateral to reduce the lender’s risk. The lender can evaluate the NFT based on demand for that particular type of asset, the NFT’s current price, the owner’s price tag, a secondary market value, and individual calculations. Lenders can then decide the interest rate and the loan amount.

Borrowers must connect their cryptocurrency wallets to the lending app. The website immediately displays the NFTs they own and prompts them to select which ones they want to utilize as collateral. They also specify how much they want to borrow, how long they want to borrow it for, and how much they would like to return in the end. Borrowers who are willing to accept counteroffers from lenders can declare their intention to do so on the website.

Loans are delivered once a lender approves the borrower’s conditions or after the borrower accepts the terms presented by a lender. The NFT used as collateral is then digitally locked and released only once the borrower repays the loan in full, plus interest, through the app. A default lets the lender seize the locked collateral.

You might be wondering why people prefer this type of loan collateralization over a conventional one. Here, lenders have the freedom to charge a huge interest rate that is far higher than the conventional setup. Similarly, borrowers can pile up unconventionally large sums as loans which are very difficult in the traditional banking system.

Fractional ownership

Whenever we see crypto-related news, the sums are mostly in millions. So only a few people can afford such huge amounts of money. It might take some time for such consumers to show up. However, if the token is fractionalized, several buyers may split the price, making the asset considerably more liquid.

One NFT divided into numerous stakes is referred to as a fractional NFT. It is implemented by a smart contract that divides one NFT into a specified number of tokens, each of which is tied to the parent NFT. Each token represents a portion of the NFT and the underlying asset.

The Fractional platform, for example, allows you to divide NFTs and produce ERC20-compliant fractions. Apart from providing liquidity, the site enables users to become fractional owners of assets that they would otherwise be unable to buy.

Insurance

The first thing that comes to our mind when we think of insurance is the tedious paperwork that accompanies insurance. DeFi and NFT are also likely to revolutionize the insurance industry, including both crypto-related assets and traditional insurance products.

Insurance policies are tokenized into NFTs, which may be traded, purchased, or sold. NFTs don’t have a closing date. So there is no need to renew. We can say goodbye to long paper works and bank verification officers.

Covercompared is such a Defi-NFT project to reduce the cost of insurance policies as well as the additional transactional and administrative costs.

Debt management

Debt management is another area transformed by DeFi NFT. Smart contracts are useful for recurring procedures like approvals and computations since they reduce time and eliminate human error. Furthermore, decentralized Finance is built on blockchain. All data is recorded on the ledger and can be accessed at any moment.

If there is NFT collateral, then the risk associated is less, and the smart contract automatically issues you the NFT if you are the lender and the borrower cannot pay you back. No other legal action is required. Hence it makes it easy to manage the debts.

Related article: Where will NFTs pop up next?

Top DeFi projects leveraging NFTs

Now let us see some top Defi projects that make use of NFTs.

Uniswap3

Uniswap is a DeFi protocol for automatic liquidity provision and cryptocurrency exchange.

Uniswap3 addressed the issue of impermanent loss (common in the Curve protocol) by implementing non-fungible liquidity pools, resulting in a whole new application for NFTs.

Liquidity providers are no longer required to spread all prices in the pool but can instead deploy their resources in a defined price range. This means that liquidity providers can get more exposure to desirable assets while minimizing downside risks.

Solv Protocol

Solv Protocol lets you do minting and trading of NFTs called Solv vouchers. Usually, tokens are locked up during the vesting period and are illiquid assets. They are released later periodically. A strategy like this assures long-term commitment from investors and team members, resulting in the project’s growth and success being reaffirmed.

Owners of locked assets can now exert active control over their assets using Solv Vouchers, including purchasing and selling, dividing, or combining the vouchers into larger entities.

To facilitate the construction and programming of complex financial products, Solv Protocol provides financial NFTs with a new token standard, ERC-3525.

NFTfi

NFTfi is a non-fungible token liquidity protocol. The system enables peer-to-peer lending and borrowing on a fully trustless approach. NFT liquidity providers use NFTfi to generate attractive returns or, in the case of loan defaults, to receive valuable NFTs.

In NFTfi , People can make their NFT available as collateral and receive loan offers from users. When they accept an offer, wETH or DAI liquidity is transferred from the lender’s wallet to the borrower’s.

For the loan term, the NFT is put into a double-audited escrow smart contract. If the borrower repays the loan before it expires, you will receive your NFT back. If they default, the lender has the right to seize and collect the NFT. NFTfi does not support auto-liquidations.

Burnt Finance

Burnt Finance is a Solana blockchain-based decentralized NFT auction protocol. The site hosts digital asset auctions and fundraising campaigns and allows users to build their own unique NFT collections.

Fast processing times (400 milliseconds) and minimal transaction prices — $0.01 is an attractive aspects of BurntFinance. The project will grow and develop an NFT marketplace with complete DeFi features, such as lending, liquidity mining with staking incentives, fractionalization, and GameFi.

WiVX

WiVX is a protocol for decentralized reserve tokens. WiVX was presented as a blockchain-based wine investing platform by WiV Technology.

A case of wine is represented by each WiV token. Having a token implies you own real-life wine. All wine cases are stored at the owner’s professional warehouse or in the WiVX merchant network. The wine will be given to the owner upon request.

The tokens can be used to begin a collection, trade them, or utilize as loan collateral.

Pods

Pods is a decentralized non-custodial options system that allows for simple cryptocurrency hedging in the NFT DeFi domain. Pods joined the Galaxy ecosystem and began their NFT incentive scheme in October 2021. The initial adopters and the most active community members will get rewards under this scheme.

The first season of the incentive program, The Awakening, included three NFT ensembles. Pods NFT holders will be able to vote on governance ideas, take specific roles in the community, and have access to early testing and research groups in the future.

Just Liquidity

Just liquidity is a financial system that aims to provide a completely decentralized experience by employing worldwide fiat apps such as Visa and Mastercard Debit Card. The system now includes an NFT staking model.

The user can stake their tokens in a pool for a set amount of time and then get an NFT to get into the next pool. The NFT functions as a form of admission ticket to a new pool, and it expires when the user joins it.

Based on the access offered, JustLiquidity’s NFT staking strategy generates a secondary market for these NFTs.

Bottom line

DeFi and NFTs are two technologies that have great potential to bring trending changes and can transform our conventional economic aspects. The proof of ownership that NFTs provide is the astounding feature that makes it valuable not only in the finance sector but also in every other arena.

Using the NFTs as collateral is changing the whole crypto lending game. NFTs add unique digital values to every asset that is being tokenized. DeFi provides the foundation to open up more possibilities for NFTs to help people make a fortune with these unique token assets.

Related article: NFT DAO: How do NFTs and DAOs coexist in DeFi?