The NFT market has been soaring over the last few years and is expected to grow by 35% by 2027. With such a big market, the purpose of buying an NFT has also become diverse. One of the primary reasons people hold NFTs is for their utility. For instance, the Bored Ape Yacht Club gives owners access to exclusive high-profile community events, including celebrities. But the NFT owners who do not redeem the utilities are just left speculating when the prices will go up. Some consider NFTs their prized possession and do not want to sell them. So how can you make the most out of the NFTs in your pocket without selling them? The answer lies in NFT rentals.

Read ahead to understand how lending and borrowing work in the NFT sector.

- What are NFTs?

- What are NFT Rentals?

- The Working Process of NFT Rentals

- Why does someone rent an NFT?

- Popular Platforms for NFT Rental

- Future of NFT rentals

What are NFTs?

Non-Fungible Tokens (NFTs) are digital tokens that are non-fungible, meaning they cannot be replaced. For example, a dollar bill can be replaced by another dollar bill. A bitcoin is fungible and can be exchanged for another bitcoin because it carries the same value, content, and purpose. So what do NFTs contain that makes them special enough to be irreplaceable?

NFTs contain digital arts, videos, music, pictures, GIFs, graphics, and more. A simple JPEG can be minted as an NFT and put up for sale. There might be different copies of the picture, but there will only be one owner for the minted NFT. Trading NFTs means transferring the ownership of the digital asset, and they can be bought with crypto or fiat currencies.

What are NFT Rentals?

NFT rentals, as mentioned before, are a novel concept in the NFT sector where the owner does not necessarily have to sell their NFTs to make money. The concept is a rental transaction between a person who needs an NFT and a person who owns an NFT. It is just like how people can make money by renting houses to tenants. The tenants will pay the rent and vacate the house once they no longer need it. In NFT rentals, the NFTs are given out on lease with a rental fee, and once the purpose is fulfilled, they will be returned to the lender by the borrower.

The Working Process of NFT Rentals

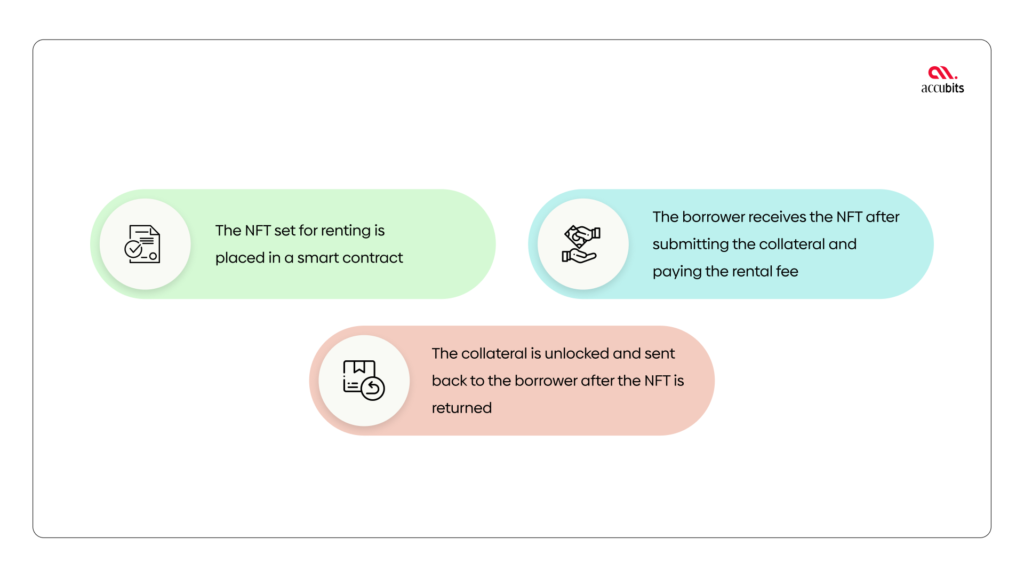

Collateralized Lending

In collateralized Lending, NFT up for rental will be placed inside a smart contract after specifying the price and the maximum renting period.

Borrowers then specify how long they want to rent or hold the NFTs. They pay the rental fee and submit collateral equal to or higher than the value of the NFT, which they get back after returning the borrowed NFT.

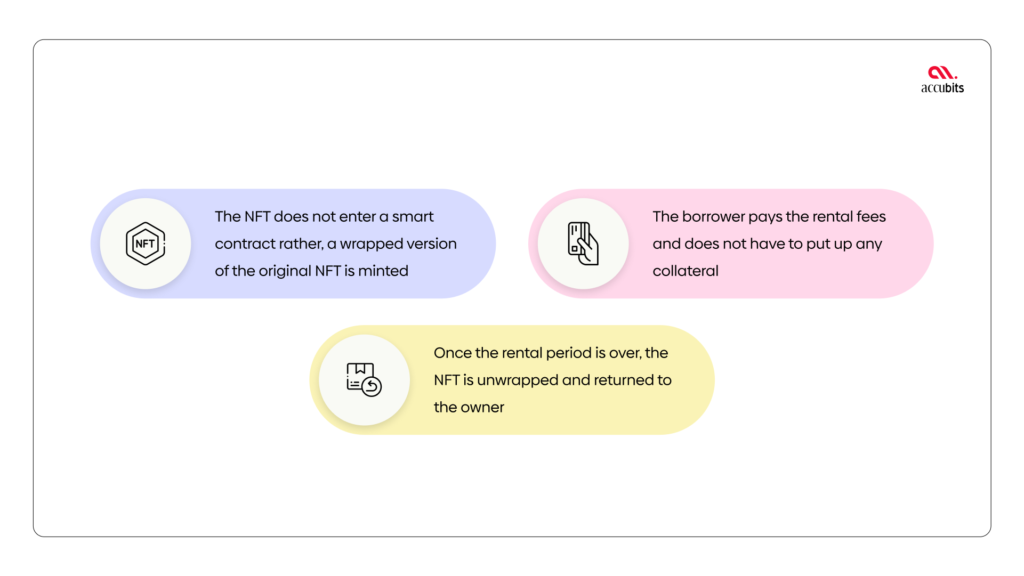

Collateral-less Lending

This method is similar to collateralized lending, except the borrower does not have to submit collateral. In an NFT rental transaction, the ownership of assets is never transferred from the owner to the buyer. For instance, the NFT renting platform ReNFT carries out collateral-less transactions where the NFTs do not enter a smart contract; rather, they are stored in an escrow.

And the NFT stored in an escrow is known as Wrapped NFT. So essentially, some rental platforms do not require the borrower to present collateral, like in the case of a crypto mortgage, as the borrowers are only temporarily using the wrapped NFTs after remitting the rental fee.

Why does someone rent an NFT?

The concept of NFT rentals is pretty simple, but why would anyone want to lend or borrow NFTs when the whole deal is about taking pride in ownership. Firstly, for the lender, the answer is obviously to make money. By lending out the NFTs that were collecting dust in their wallet, the lender can create a source of income and a secondary economy in the ecosystem involving NFTs that lie idle. Lenders get to monetize their NFTs without having to give up ownership.

For example, the Flyfish Club by Gary Vaynerchuk is known as the world’s first NFT restaurant, and people who hold the Flyfish Club NFT get unlimited access to food in the private dining room of 10,000+ sq. If a Flyfish NFT holder is not using it, they can lend it to someone and make a profit out of it.

For the borrower, renting NFTs is a cheap way to access NFT-related utilities without paying thousands. For instance, Hollywood actress Mila Kunis has an NFT TV show titled “Stoner Cats.” Stoner Cat NFT holders get to watch the series. Let’s say a person has watched all the released episodes. They can then lend the NFT to someone else and make money. For the borrower, it is like renting a DVD; they watch the show and return it, which is much cheaper than buying it.

In the bigger picture, NFT rentals provide an alternative to the regular speculative trading of digital assets. It also addresses the highly inflated prices of NFTs that rule out an entire class of buyers who cannot afford them. In addition to NFT rentals, a few developments in the NFT sector, such as Fractional NFTs, have particularly aimed to make NFT buyable for everyone.

Popular Platforms for NFT Rental

There are only a few NFT lending platforms as rental NFTs are relatively a new concept. Some of the well-known NFT rental platforms existing at your disposal currently include:

ReNFTs

ReNFT is a peer-to-peer rental protocol that enables the lending and borrowing of NFTs on Ethereum. ReNFTs recently facilitated the rental of Animetas NFT, giving access to a private Discord event. When the lender submits their NFT for renting, the ReNFT holds it in an escrow until a buyer comes along. ReNFT focuses on expanding to the metaverse and has recently gained much traction. Animoca Brands, a Hong Kong-based software and venture capital company, raised USD 1.5 million in seed funding for ReNFTs. The platform is currently in the works to include Solana and Polygon blockchain.

Vera

Vera is a decentralized protocol built on prominent blockchains allowing services for NFTs such as borrowing, lending, and mortgages. The platform supports non-collateralized lending. Amonica’s venture capitalists raised USD 3 million in Vera. Vera has crossed $2 million in NFT rental and partnered with over 50 NFT apps and brands since its genesis in 2021. Vera won the best DeFi app of the year by the Panony group and a grant from Web3 Foundation.

TRAVA

TRAV is the world’s first decentralized cross-chain lending platform, and in October 2021, TRAVA, in association with GameFi, launched its NFT rentals marketplace. Most NFT rental approaches by platforms have only a few lending pools, with their own measures for borrow/supply interest rate, liquidation threshold, and Loan-to-Value ratio. They also have a limited list of exchangeable cryptocurrencies.

TRAVA stands out from others by offering users a flexible mechanism to create and manage their lending pools for their rental businesses. TRAVA also provides a credit-score function based on financial data analysis to help users gain more profit with fewer risks.TRAVA has seen an influx of NFT rentals where many players deposited NFTs in the pool for others to use. The platform aims to make GameFi accessible at the lowest cost through lending and borrowing.

IQ Protocol

IQ Protocol announces its expansion into the NFT lending and borrowing market with financial backing from over 30 blue-chip venture capital firms and private investors. The platform allows renting of expirable assets without the need for collateral. Both fungible and non-fungible tokens with utility towards subscription models and GameFi assets are supported by IQ Protocol. Token holders can create a sustainable token economy by deploying a renting pool.

Future of NFT Rentals

NFT rentals are poised to enable the Web 3.0 economy with more access to NFTs. The utility of NFTs has been the main driving force for borrowers to consider renting. By looking at the rising success of NFT rentals and the secondary economy, developers are likely to focus more on attaching market-relevant utility to NFTs. Rental protocols can extend into many sectors of NFT.

For example, NFT rentals have already stepped into the metaverse supporting rentals in play-to-earn games, virtual real estate, and even intellectual property. One potential use case of NFT rentals could be in the art industry. Artists can rent their digital arts for a day to borrowers to display them in a virtual gallery event or a museum. In the future, NFT rentals could be carried out for more than just utility purposes as there is no limit to the other creative ways that can come up.